What incentives are available for businesses in Ontario (Canada) to help the transition to renewable energies?

What if you were paid for the transition of your building to renewable energy?

October 25, 2021

This article is the second of a series of articles presenting the various programs and incentives available for businesses across Canada and around the world to help them fully or partially transition to renewable energy. In our first article, we presented the various programs available in the Atlantic provinces of Canada and we are now moving west, to central Canada, starting with Ontario.

Stay tuned as we continue our tour of all Canadian provinces over the next few weeks.

First let’s look at the province of Ontario’s energy profile.

Ontario Energy Profile

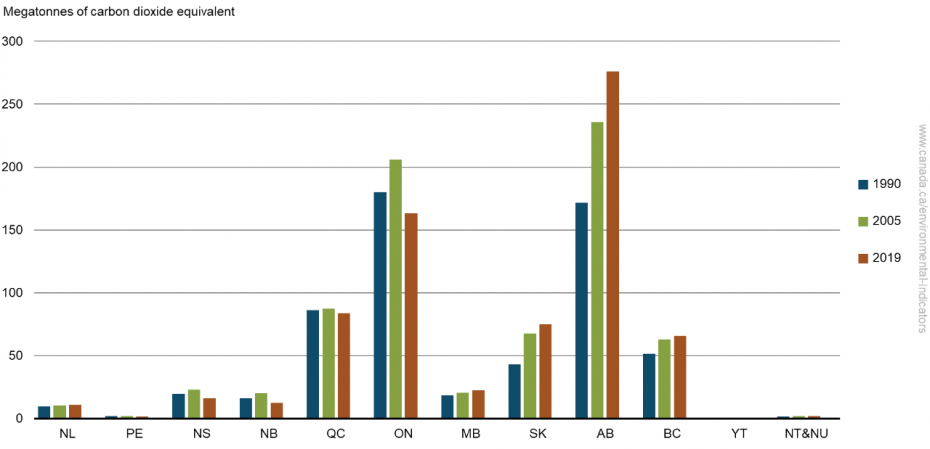

In 2019, the combined emissions from Alberta and Ontario, the largest emitters of Greenhouse Gas, represented 60% (38% and 22%, respectively) of the national total.

In 1990, Ontario's GHG emissions were higher than those from the other provinces because of its large manufacturing industry. Alberta's emissions subsequently surpassed Ontario's, with an increase of 61% since 1990, primarily due to the increase in the oil and gas industry. Ontario's emissions decreased between 1990 and 2019 primarily because of the closure of coal-fired electricity generation plants.

Table 1: Greenhouse gas emissions by province and territory, Canada, 1990, 2005 and 2019

The largest emitting sectors in Ontario are transportation at 35% of emissions, heavy industries (including iron, steel, and chemicals) at 24%, and buildings (residential and commercial) at 22%.

Based on 2018 data, Ontario is the 2nd largest producer of electricity in Canada and home to over 98% of Canada’s solar installations. Ontario currently ranks 5th in the list of provinces for solar potential in Canada by energyhub.org. In 2018, about 96% of electricity in Ontario was produced from zero-carbon emitting sources: 60% from nuclear, 26% from hydroelectricity, 7% from wind, and 2% from solar.

But Ontario’s total energy demand is still one the largest in Canada (2nd largest in 2017) with the Industrial and Commercial sectors combined accounting for more than half of the demand (53% in 2017). In terms of fuel types, Natural Gas accounted for 28% of the demand, behind Refined Petroleum Products (RPPs) at 48% and in front of electricity at 16%. Ontario natural gas demand represented 24% of total Canadian demand in 2017, making it the largest natural gas consuming province after Alberta.

Available Programs and Incentives in Ontario

Now that you have a better understanding of Ontario’s energy profile and GHG emission sources, let’s look at the various programs and incentives available for businesses in Ontario to help the transition to renewable energy.

Even if Ontario has largely improved its GHG emissions since 1990, a lot of work is still required to reach the various targets set by the federal and provincial governments as well as the city of Toronto. And as we can see from the data presented above, the commercial and industrial sectors can play a big role in reducing GHG emissions in Ontario (and around the world). Renewable energy systems can also increase building resiliency (just like an emergency generator) and even reduce your energy costs.

Here’s a few programs and incentives available in Ontario as of October 1st, 2021. It’s important to note that although the province has many programs and incentives for energy efficiency such as the Retrofit Program, this article will focus on programs helping commercial, industrial and institutional organisations fully or partially transition to renewable energy.

RENEWABLE ENERGY TAX SAVINGS AVAILABLE ACROSS CANADA

As presented in our review of Atlantic Canada programs, the Canadian government offers attractive tax savings to make the energy transition. Under classes 43.1 and 43.2 described in Schedule II of the Income Tax Regulations, certain capital costs associated with systems that produce energy from renewable energy sources or from fuels derived from waste or who save energy by using fuel more efficiently are eligible for an accelerated capital cost allowance.

To be eligible as Canadian renewable and conservation expenses (CRCE), expenses must be incurred in respect of a project for which it is reasonable to expect at least 50 percent of the capital costs incurred for the project would be the capital costs of equipment described in Class 43.1 or 43.2.

According to the technical guide for categories 43.1 and 43.2, here are some categories that are eligible for these tax savings for renewable energy:

- Geothermal pump

- Wind energy conversion systems

- Photovoltaic electricity production equipment

- Geothermal energy equipment

- Equipment for producing electricity from wave, tidal or tidal energy

- District energy networks / district energy network equipment

- Electrical energy storage equipment

- Charging stations for electric vehicles.

Source: Tax Savings for industry https://www.nrcan.gc.ca/science-data/funding-partnerships/funding-opportunities/funding-grants-incentives/tax-savings-industry/5147

RENEWABLE ENERGY TAX SAVINGS AVAILABLE IN ONTARIO

1 - Net Metering

Replacing the previous FIT (feed-in Tariff) Program, the new Ontario Net Metering program allows individuals and businesses to lower their electricity bill by generating power with wind, solar or other renewable energy sources.

Once approved and connected to the grid, you can receive a credit directly on your electricity bill for electricity that is sent back to the grid.

Net metering may not be available for all buildings and all regions. For more information, contact your local distribution company.

2 - TransformTO

TransformTO is Toronto’s ambitious climate action strategy. Unanimously approved by City Council in July 2017, it includes a set of long-term, low-carbon goals and strategies to reduce local greenhouse gas emissions and improve our health, grow our economy, and improve social equity.

On October 2nd, 2019, City Council voted unanimously to declare a climate emergency and accelerate efforts to mitigate and adapt to climate change, adopting a stronger emissions reduction target of net zero by 2050 or sooner. Toronto’s greenhouse gas (GHG) emissions reduction targets are now as follows (based on 1990 levels):

- 30% by 2020

- 65% by 2030

- Net zero by 2050, or sooner

Here’s a list of incentives and programs derived from this initiative and available to businesses in the Toronto area.

2.1 – Grants, by TAF (The Atmospheric Fund)

You are eligible for funding if:

- You are a municipality, non-profit organization, or a registered charity based in the Greater Toronto and Hamilton Area (GTHA).

- Your project has the potential to generate large-scale carbon reduction in the GTHA.

More information : https://taf.ca/grants/

2.2 – Project Financing, by TAF (The Atmospheric Fund)

Cleantech companies and projects are generating low-carbon solutions to power the next economy. TAF is investing in these high-quality opportunities and bringing other investors along with them.

More information : https://taf.ca/impact-investing/

2.3 - Energy Retrofit Loans

Through its Energy Retrofit Loan program, the City offers low-interest loans to help building owners improve the energy efficiency of their buildings. All buildings located in Toronto are eligible.

The City offers financing for up to 100% of project costs, at a rate equal to the City’s cost of borrowing, with repayment terms up to 20 years.

Eligible projects include:

- Lighting retrofits

- High-efficiency boilers, chillers and HVAC

- Building envelope improvements

- Building automation systems and controls

- Heat pumps

- Renewable energy projects

- Energy storage

- Fuel switching

- Other retrofit measures/technologies

3 - SolarTO

The City of Toronto offers complimentary consultations and guidance to residents and businesses to support the installation of solar PV systems on Toronto’s homes and buildings.

SolarTO offers the following services, at no cost, for commercial buildings and properties located in Toronto:

- Solar PV (rooftop)

- Online visual check to determine opportunity.

- Zoning verification and conceptual layout/system sizing and budgetary estimates.

- Assistance with completing the preliminary Toronto Hydro Distributed Energy Resource (DER) application.

- Solar Carport (Parking Lot)

- Online visual check to determine opportunity

- Zoning verification and conceptual layout/system sizing and budgetary estimates

- Assistance with Toronto Hydro DER application, assistance with geotechnical analysis and EASR/REA guidance.

- Energy Storage

- Options and high-level consultation (cost and capacity), briefing on Class A.

- Conceptual size and output, budget estimates.

- Assistance with Toronto Hydro DER application. Guidance on completing a feasibility report with a third party.

CONCLUSION

If you own or have a long-term lease on a commercial, industrial or institutional building in Ontario, we invite you to explore the benefits of renewable energy.

Transitioning your building(s) to renewable energy is easier than ever and can help you reduce your GHG Emissions, increase your resiliency and even reduce your energy costs.

And with solutions like vadiMAP, you can easily find out the potential of renewable energy and receive a personalized energy and thermal system prescription for a fraction of the cost normally charged by traditional engineering firms.

Contact us now to learn more or visit our website. Together, we can make a difference.

What's next?

Start your transition now in a few clicks with the vadiMAP prescription!