What Building Owners Need to Know About IFRS S1 & IFRS S2 Standards (Not to Get Caught Off Guard)

October 24, 2023

Earlier vadiMAP published an article starting with this question:

Should building owners bet on AI to achieve Net Zero? Answer: Big yes for several reasons.

Now vadiMAP publishes this article starting with a complementary question:

Should investors trust building owners aiming to achieve Net Zero? Answer is below.

In the ever-changing world of finance and real estate management, building owners and their CFO/COO/CEOs must be acquainted with the standards that may impact their financial reporting and their reputation. In recent years, International Financial Reporting Standards (IFRS) have undergone significant updates, with IFRS S1 and IFRS S2 being two substantial additions. In this article, we examine the meaning of these standards and implications for building owners adopting pragmatic ESG (Environmental, Social and Governance) practices.

Overview

All around the world, the ESG landscape is taking shape. Accordingly on June 26, 2023, the International Sustainability Standards Board (ISSB) issued its first two standards, IFRS S1 and IFRS S2.

These standards address disclosure requirements relating to a company’s carbon emission targets to mark an important milestone in the standardization of corporate sustainability reporting. Therefore, IFRS S1 and IFRS S2 standards are intended to improve ESG declarations, simplifying the reporting burden and enhancing the usefulness of sustainability disclosures for investors making decisions.

The interoperability between IFRS S1 and IFRS S2 means that companies can now take action to apply the ISSB standards to accelerate preparedness for regulatory requirements around the world. It is now a fact that IFRS S1 and IFRS S2 publications are currently addressed by local jurisdictions to codify the standards.

Why should building owners care?

First and foremost, it is all about being a responsible corporate citizen transparently reporting a comprehensive strategy to reach and sustain tangible ESG objectives with its own real estate assets.

All public companies, including Small and Medium Enterprises (SMEs) dealing with them, will be obliged to disclose Greenhouse Gas (GHG) emissions with a comprehensive strategy. Most importantly, companies must manage both standards with year-over-year disclosures as a systematic process.

Several stakeholders will require a fully compliant sustainability reporting – e.g. lenders, equity investors, insurance companies, etc. These will have a direct impact on the cost of capital, borrowing rates and insurance premiums. In addition to financial considerations, companies will expose their brands to additional risks and opportunities from their employees and customers, all seeking responsible practices.

"Meeting IFRS S1 and IFRS S2 standards demonstrates that carbon emission reduction targets are managed with a holistic strategy, including risk mitigation and opportunity management."

Provisions of the standards IFRS S1 and IFRS S2

IFRS S1 and IFRS S2 create a global baseline for sustainability disclosures. Beyond the general sustainability reporting requirements in IFRS S1, the climate-related disclosures are covered within IFRS S2.

Together, both standards assure information needed by investors as a starting point for securities regulators. The objective of the standards is to require an entity to disclose decision-making useful information about its climate and sustainability-related risks and opportunities as an audited statement, along with financial statements. IFRS S1 and IFRS S2 require an entity to disclose information about all material sustainability-related risks and opportunities that could reasonably be expected to affect cash flow, access to financing, or cost of capital over the short, medium, or long term.

In the context of sustainability-related financial disclosures, IFRS S1 defines material information in alignment with the International Accounting Standards Board’s (IASB®’s) definition, which states that information is considered material if omitting, misstating, or obscuring it could be reasonably expected to influence decisions that primary users make based on that reporting.

Therefore, disclosures should include qualitative and quantitative information on governance, strategy, risk management, targets and metrics.

What’s next?

Since the standards are effective from January 1st 2024 for the exercises beginning on or after January 1st 2023, the company fiscal period ending Dec 31st 2024 or later will require an audit with ISSB disclosures.

Not to be caught off guard, building owners need to start planning governance, strategy, risk management, targets and metrics. Just like financial reporting, building owners must instill an equal prominence on sustainability (not just climate-related risks and opportunities) to disclose material information for investors and creditors for the first fiscal year as follow:

> Governance

Asset Management, Processes and Controls for Sustainability Risks and Opportunities

> Strategy

Business Model Enhancement on the Short, Medium and Long Term per Sustainability and Climate

> Risk Management

Identification, Assessment and Management of Sustainability Risks and Opportunities

> Targets and Metrics

Performance Management On Scope 1 and 2 Related Activities (Scope 3 for Next Fiscal)

The disclosure must focus on matters that are critical to the way the company operates, relating to finance, continuity of operations and carbon-related matters. Additional standards such as ISO or industry-specific models should be reported to provide complete sustainability disclosure.

Implications and Tangible Actions

Building owners need to recognize the importance of complying with these standards. Adhering to IFRS S1 and IFRS S2 ensures that statements accurately provide stakeholders with a clear picture of sustainability risks and opportunities. Further, IFRS S2 ensures that benefits are accounted for transparently, allowing building owners to manage building-related costs more effectively.

Here are examples of tangible actions for each provision:

> Governance

Leadership appointments, Energy Data & Moneytization, Connecting the Dots (e.g. SBTi, ISO, Leed, etc.)

> Strategy

Business Model Incorporating Sustainability Enhancements for Customers, Clients and Shareholders

> Risk Management

Holistic and agnostic toolset to identify, assess and manage building CapEx and OpEx priorities

> Targets and Metrics

Benchmarks to Reduce Scope 1 and Scope 2 Emissions - e.g. Energy Star Portfolio Manager

IFRS adoption also has intangible levers that could move towards well-deserved reputational improvement rather than reputational damage. A company or entity regulated by IFRS standards doing its ESG homework could disclose significant E, S or G developments such as:

- Comparing net zero roadmaps with own resources, consulting firms, traditional contractors, renewable energy certificates, or vadiMAP leveraging AI with building energy expertise;

- Supporting a local battery value chain to expand the use of renewable and intermittent energy such as solar and wind power and most importantly, avoid non responsible supply chains; or,

- Avoiding carbon credits often ending with pledge leakage or double counting.

Conclusions for Building Owners

Staying informed on IFRS S1 and IFRS S2 is critical for building owners not only to comply but to build value at the intersection of finance and operations, and stay ahead of competitors with a sense of responsibility.

" Investors needed an antidote for greenwashing perpetuated by companies or vendors using non verified, obscure or confusing sustainability offerings – so IFRS standards will put a spotlight on highly responsible companies managing real estate assets while seriously looking at sustainability and profitability together.”

A strategy must be adapted, revisited or created from scratch to include sustainability. That must trigger necessary actions with appropriate attention. Mapping the whole portfolio of buildings will ensure risks and opportunities are prioritized with a true holistic approach, meaning to start by knowing how much carbon emissions are emitted today (reference “load energy profile” or digital twin). Then and only then the most prominent actions can be sorted to build the most value with the least effort, as early as possible to curb carbon emissions.

No Company should jump on any single technology or popular application such as HVAC, energy efficiency or on-site energy generation without knowing what their position is today, vs similar type of operations. Before deploying capital, homework with the best available experts must come first, more likely those equipped with proven IT/OT technologies such as AI to simplify the process for years to come. That will ensure one single version of the truth for all your buildings, regardless of their locations.

Attention to IFRS S1 and IFRS S2 will inevitably lead to:

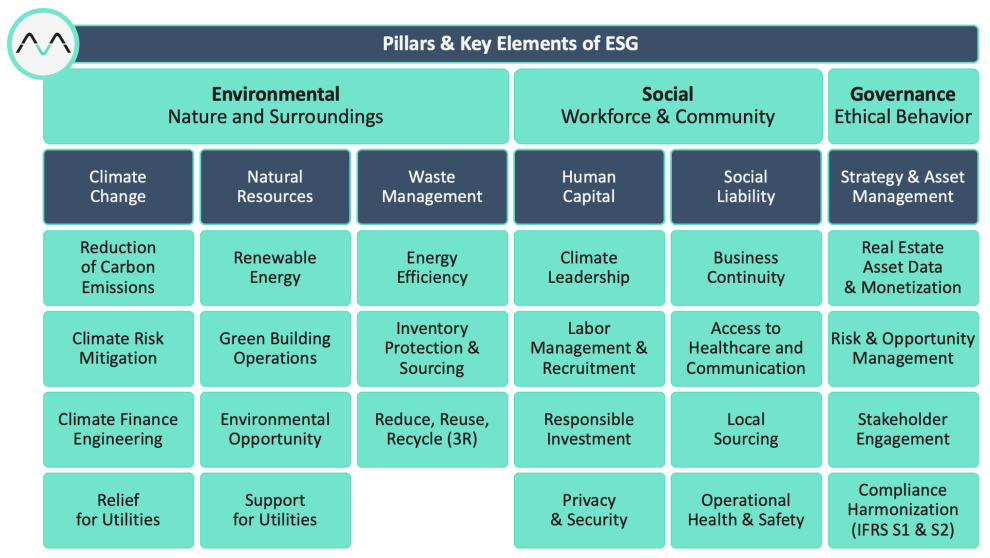

- Making big steps on the company ESG roadmap (see ESG picture below with vadiMAP coverage);

- Prioritizing conversion projects according to ROI, business continuity and footprint reduction;

- Complying with Building Performance Standards (Energy Star Portfolio Manager);

- Separating real estate assets and liabilities related to financial statements; or,

- Tracking carbon emission targets while monitoring savings, business uptime and carbon footprint.

Regardless of where building owners are operating their real estate assets in the world, vadiMAP will accompany building owners on their net zero journey and as need be, support Auditors and Advisory firms in a collaborative effort.

To all CFOs/COOs/CEOs responsible for real estate, if ESG sounds like a real call to action, simply contact vadiMAP to implement your own plan, one that will be simple, timely and profitable.

" To answer the question: investors will finally be able to trust CFO/COO/CEOs aiming to achieve Net Zero with transparency, meaning complying with IFRS S1 and IFRS S2 disclosures.”

.jpg)

About the Author

Dan Boucher co-founded vadiMAP with the current CEO Jeremy S.Boucher and CTO Nicolas Mary. Dan has over 25 years of experience in energy and automation markets. He worked with some of the globe’s largest international companies in this sector, on a national, North American, and global basis. Boucher is currently the chairman of vadiMAP.

References

Sustainability reporting – Responding to ISSB proposals (KPMG)

Get ready for ISSB sustainability disclosures - June 2023 (KPMG)

Global ESG Disclosure Standards Converge: ISSB Finalizes IFRS S1 and IFRS S2 - Deloitte

New ISSB guidelines | Acuity Knowledge Partners – Acuity KP

Sustainability reporting updates | CPA Canada

First ISSB Reporting Standards Are Out, What Investors Must Know - Carboncredits